llc s corp tax calculator

As a sole proprietor you would pay self-employment tax on the full 90000 90000 x 153 13770. As youre running through the calculations above be sure to talk to a financial pro to help you weigh the.

Investment Return Illustration Llc Vs C Corp Central Texas Angel Network

An LLC vs.

. From the authors of Limited Liability Companies for Dummies. You can form an LLC to run a business or to hold assets. S pringmeyer Law is a corporate transactions and intellectual property law firm for startups and investors in software hardware and other tech ventures.

1895 Total Savings From S-corp Conversion 1895 2 Review the Costs to Convert to S-Corp Initial state registration cost to. Corporate tax rate calculator for 2020. This application calculates the federal income tax of the founders and company the California state franchise tax and fees the self-employment tax for LLCs and S-Corps pass-through.

In this example the LLC would pay a higher overall fee. We are not the biggest. I created this S corp tax savings calculator to give you a place to start.

The owners of an LLC are members. S-corporation tax calculator can help you determine your tax obligations based on the type of business structure you want to create6 min read 1. This calculator helps you estimate your potential savings.

Therefore an S corporation with a net income of 1 million owes 15. Use the LLC tax calculator below to find out what your company will owe this tax year. Keep in mind that this is an estimate and you should always have your LLCs taxes filed.

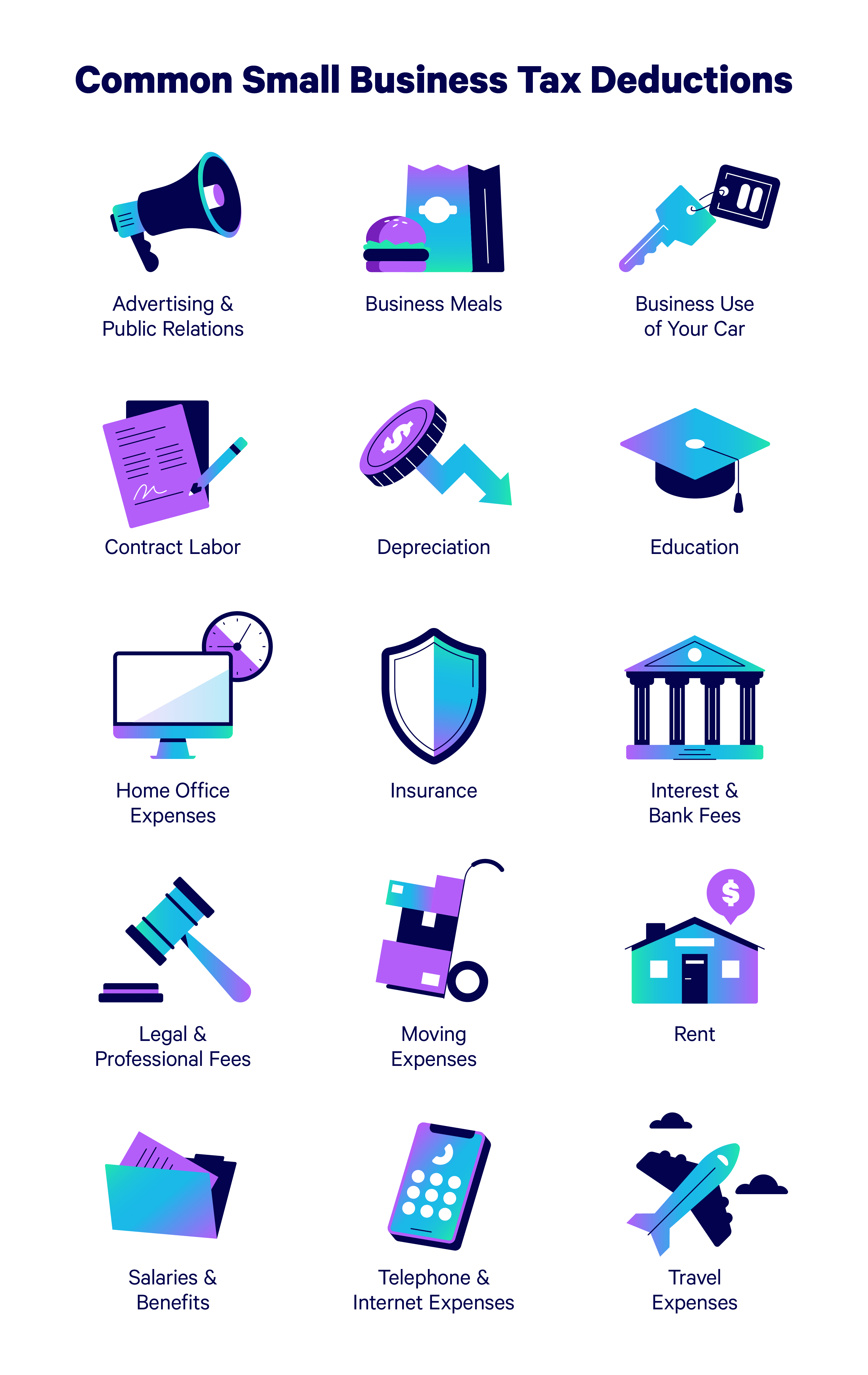

We serve clients in San Francisco. But as an S corporation you would only owe self-employment tax on the 60000 in. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses.

A limited liability company LLC blends partnership and corporate structures. How Will A Business Tax Calculator Help Small Businesses. For example if you have a.

Annual Self Employment tax as an S-Corp 19125 You Save. Forming an S-corporation can help save taxes. LLC it would pay a tax of 900 plus 800 in franchise tax.

The minimum franchise tax is 800 even for S corporations that claim zero or negative net income. Lets make some comparisons based upon a 15 net profit margin for. Lets calculate your canadian corporate tax for the 2020 financial year.

/taxes-81cd980fbf244bbc919ba651d7204367.jpg)

How Do I Calculate Estimated Taxes For My Business

The Complete Guide To Llc Taxes Bench Accounting

Converting From C To S Corp May Be Costlier Than You Think

S Corporations Vs Llc Example Of Self Employment Income Tax Savings My Money Blog

How To Calculate Tax Liability As A C Corp Hall Accounting Co

S Corp Taxes S Corp Tax Benefits Truic

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Calculating Additional Tax On The Sale Of S Corp Stock Windes

Business Entity Comparison Harbor Compliance

Llc Vs S Corp What Are They And How Are They Different Forbes Advisor

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

How An S Corporation Reduces Fica Self Employment Taxes

Lumanu Blog S Corps For Creators Why It S The Mvp Of Growing Your Businesses

Free Llc Tax Calculator How To File Llc Taxes Embroker

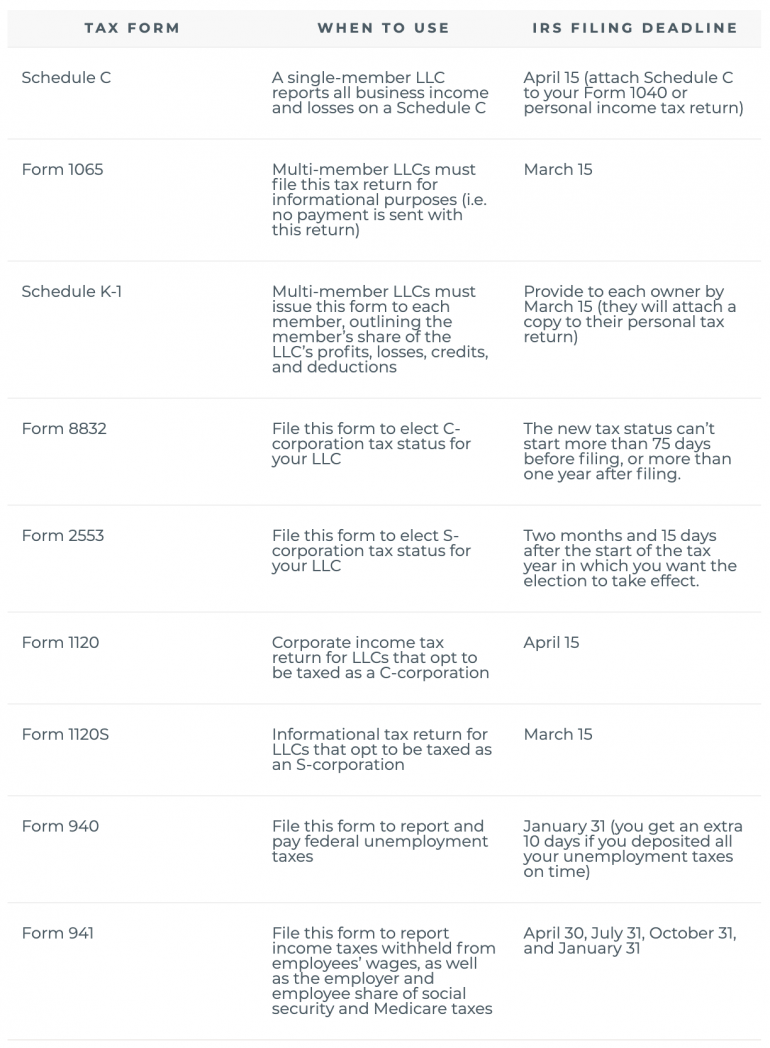

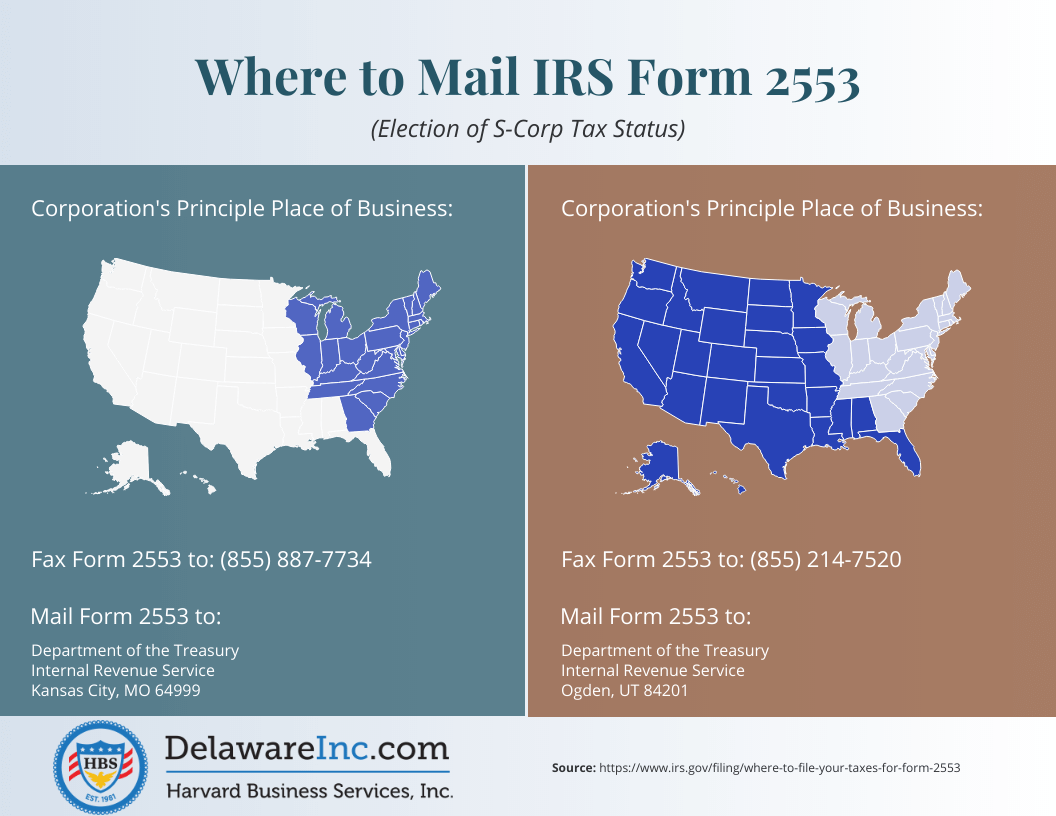

Filing S Corp Status On A New Delaware Corporation Harvard Business Services