tax abatement definition accounting

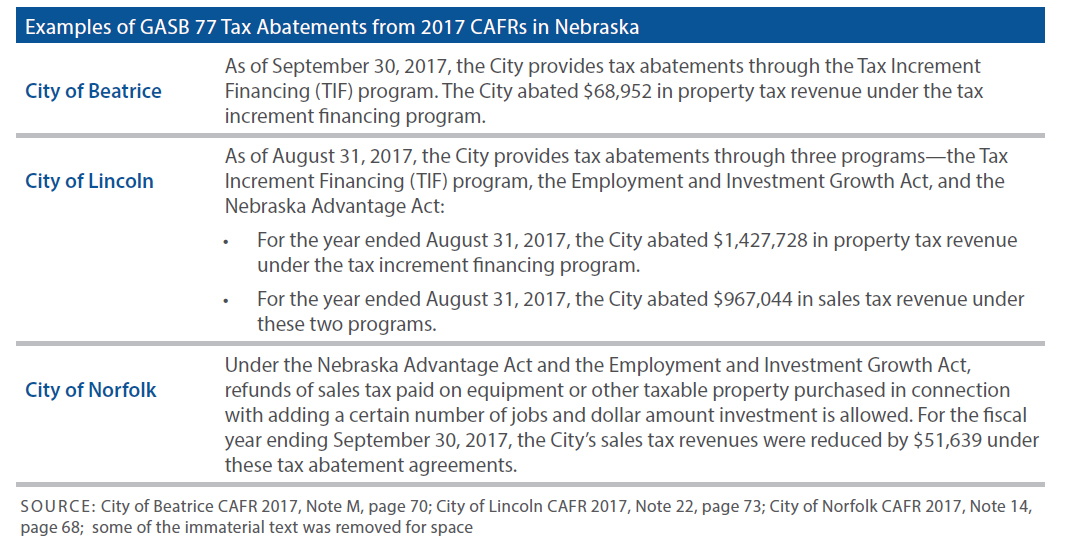

The remaining amount of future tax revenues to be abated. 77 Tax Abatement Disclosures provides a definition of tax abatements which is for financial reporting purposes only and identifies required note disclosure related to tax abatements.

Part Ten Other Types Of Tax Accounting City Maintenance And Construction Tax Definition City Maintenance And Construction Tax Is The Country To Engage Ppt Download

Under a tax abatement agreement a government reducesor abatesthe taxes a company or person otherwise would owe.

. Office of the New York State Comptroller Subject. Tax abatement is a reduction in tax revenues that results from an agreement between one or more governments and an individual or entity in which. 77 Tax Abatement Disclosures that will require those state and local governmental entities that offer tax abatements to provide details about the program or programs in the note disclosures.

One or more governments promise to forgo tax revenues to which they are otherwise entitled and. The company or person in turn takes a specific action that contributes to economic development or otherwise benefits the government or its citizens. A reduction in the amount of tax that a business would normally have to pay in a particular.

One or more governments promise to forgo tax revenues to which they are otherwise entitled. A reduction in tax revenues that results from an agreement between one or more governments and an individual or entity in which. TC 420421 will be present.

Recently the GASB published GASB Statement No. A sales tax holiday is another instance of tax abatement. The term abatement refers to a situation where an economic burden is reduced.

A reduction of taxes for a certain period or in exchange for conducting a certain task. Primary Business Codes PBC 295 through 299 indicates SBSE campus assessments. Reporting Tax Abatements as Required by GASB Statement No.

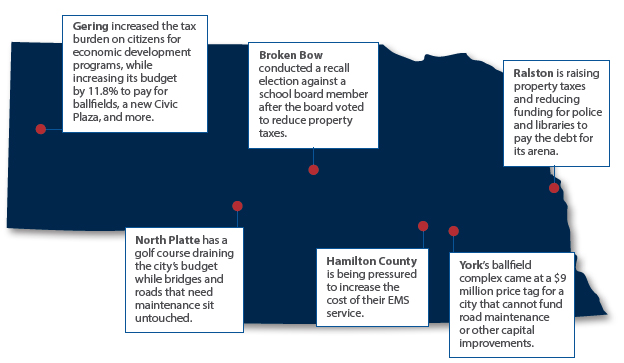

The term commonly refers to tax incentives that attempt to promote investments that boost economic growth or provide other social benefits. Whether revitalization efforts will ultimately prove successful is a big question mark. Such arrangements are known as tax abatements.

35210 Property tax revenue should be recognized in the period for which levied regardless of when they are due or collected. Defines a tax abatement as a reduction in tax revenues that results from an agreement between one or more governments and an individual or entity in which. This burden might take the form of a debt an import tariff a tax a fine a penalty or a reduction of the percentage being charged like an interest rate or a tax bracket reduction.

Tax class 2 with Document Code 10 and Julian date of 888 in the DLN. The amount of foregone tax revenues abated in the prior two reporting periods. Applied to property tax savings resulting in practice when a local authority leases a project to a company.

Tax abatement n Steuernachlass m. The purpose of this bulletin is to provide information to local governments and school districts on the financial statement reporting requirements for tax abatements as required by Governmental Accounting Standards Board GASB Statement No. It should be reported on the date which the government has an enforceable legal claim to the resources or in the beginning of the period.

For instance local governments may offer abatements to cover the cost of building new infrastructure to incentivize development or. Tax abatement defined as the decreasing of the tax responsibility of a firm by government is one of the tools which government uses to motivate behavior in a firm. A one or more governments promise to forgo tax revenues to which they are otherwise entitled and.

Calling this tax abatement means that for example a. Tax abatement synonyms tax abatement pronunciation tax abatement translation English dictionary definition of tax abatement. Tax Abatements Statement 77 applies only to transactions meeting this definition.

The primary purpose for this new requirement is to provide. The tax abatement is an incentive to encourage people to redevelop and move into these areas. 352 Accounting and Reporting of Property Tax.

To increase savings or spending rate invest in equipment or others. For example if one receives a tax credit for purchasing a house one receives tax abatement because one pays less in taxes than heshe otherwise would. The savings in that case results from the difference in the taxability or valuation of the lease.

Tax abatements are the most frequent scenarios where the term is employed and they are a reduction or exemption. The time remaining on tax abatement agreements. A tax abatement credit is generally given to a firm when the government wants the saved money to be spent in another way.

35 Deferred OutflowsInflows of Resources. The Governmental Accounting Standards Board GASB Statement No. The number of tax abatements in effect at the end of the prior two reporting periods.

TC 300 with File Location Codes 17 19 28 29 or 49 for SBSE or 07 08 09 18 or 89 for WI. In broad terms an abatement is any reduction of an individual or corporations tax liability. Tax abatement represents a reduction of government revenue and therefore may.

The tax amount assessed will appear as a TC 300 Examination SFR Assessment.

The Basics Of Double Entry Accounting Community Tax

Due Dates Advance Tax Payments Tax Payment Due Date Tax Deducted At Source

What Is A Deferred Tax Liability Community Tax

Part Ten Other Types Of Tax Accounting City Maintenance And Construction Tax Definition City Maintenance And Construction Tax Is The Country To Engage Ppt Download

Part Ten Other Types Of Tax Accounting City Maintenance And Construction Tax Definition City Maintenance And Construction Tax Is The Country To Engage Ppt Download

Part Ten Other Types Of Tax Accounting City Maintenance And Construction Tax Definition City Maintenance And Construction Tax Is The Country To Engage Ppt Download

Benefits Of Bookkeeping Bookkeeping Accounting Fiscal Year

Tds Tcs General Information Due Date To Deposit Tds And Tcs Issuance Of Tds Certificate Accounting Taxation Due Date Dating Income Tax Return

Part Ten Other Types Of Tax Accounting City Maintenance And Construction Tax Definition City Maintenance And Construction Tax Is The Country To Engage Ppt Download

Myeducator Accounts Payable Accounts Receivable Net Income

Chapter One Taxation An Overview Ppt Download

The Basics Of Double Entry Accounting Community Tax

What Is The Accounting Cycle A Step By Step Guide Community Tax

Part Ten Other Types Of Tax Accounting City Maintenance And Construction Tax Definition City Maintenance And Construction Tax Is The Country To Engage Ppt Download